You caught the potential customer’s attention, you got them to download your lead magnet, and you made your sales pitch.

But they decided that they aren’t interested. What should you do?

You could accept the loss and move on…

Or you could present them with a downsell.

An effective downsell can help you make more sales, increase customer lifetime value and improve your bottom line.

Ready to stop leaving money on the table?

Continue reading…

What is a Downsell?

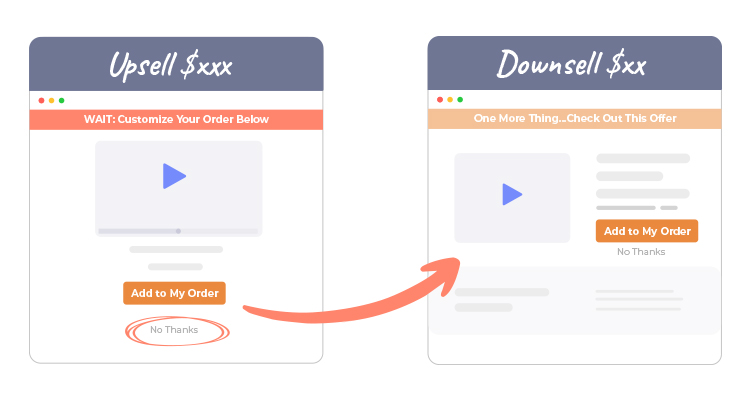

A downsell is an offer that you make to the potential customer after they have declined your initial offer.

As the name suggests, the former is a downgrade from the latter, with the idea being that the potential customer may be interested in a less expensive product.

For Example:

When you go to a car dealership to buy a car, the salesperson is likely to start by selling you on the most expensive car that is within your price range.

But if you decline that offer, they may suggest a less expensive car instead.

That creates a possibility of you buying it.

Meanwhile, if the salesperson would have let you go after you declined their first offer, they would have lost that opportunity to make a sale.

What are the Benefits of Downselling?

Let’s take a look at the three key benefits of downselling:

Extra Revenue

A downsell is the last-ditch attempt to make a sale.

Sure, it would have been better to persuade the potential customer to purchase your initial offer, but that did not happen.

You have nothing to lose at this point. So it makes sense to make one last try to sell them something.

Note that even the most affordable downsells can add up to a significant amount of extra revenue over time.

A $7 downsell generates:

- $70 from 10 sales

- $700 from 100 sales

- $7,000 from 1000 sales

These may not be life-changing sums of money, but they are nothing to scoff at either.

Would you refuse a $70, $700 or a $7,000 lottery win? Of course not. So why would leave that extra revenue on the table?

Getting the Customer to Take the Next Step in Your Sales Funnel

Robert Cialdini discussed six principles of persuasion in his best-selling book “Influence”.

One of these principles is called commitment and consistency. It says that we value consistency in others and want to be seen as consistent ourselves.

What it means in the sales context is that a person who has already bought something from you is more likely to be open to your subsequent offers.

Although a downsell may not make you a ton of money, it still gets the customer to take the next step in your sales funnel. And that makes it easier for you to sell other products to them.

Increased Customer Lifetime Value (CLV)

Getting a potential customer who would have otherwise bought nothing to buy something generates extra revenue.

But due to the commitment and consistency principle we have just discussed, it also makes them more likely to spend money on your products in the future. That raises the average customer lifetime value of your business.

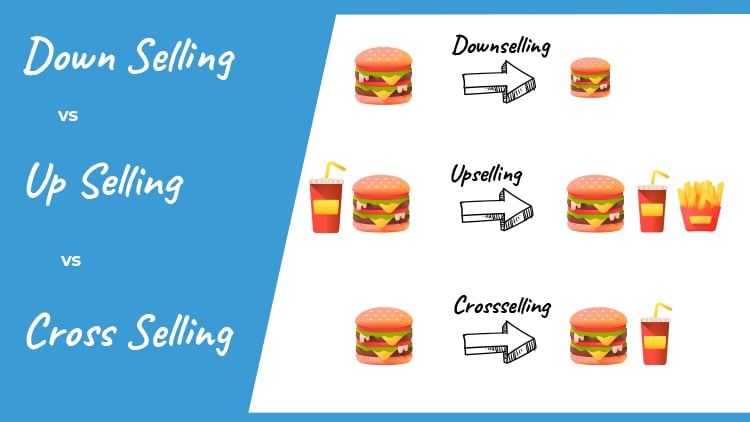

Downselling vs Upselling vs Cross selling

You already know that downselling is a sales technique where you offer the potential customer a less valuable and less expensive product known as a downsell after they have rejected your initial offer.

But this isn’t the only sales technique that is used to increase the average order value, customer lifetime value, and revenue. There are also upselling and cross selling.

Let’s take a look at these two sales techniques and see how they are different from downselling.

What is an Upsell?

An upsell is an upgrade to the product that the potential customer has already decided to buy.

A classic upselling example is the McDonald’s upsell of “Would you like to supersize that?”. The person is about to buy a meal and the cashier offers them to increase its size.

Upselling is effective because when someone has already decided to buy something, they are likely to be open to an offer that increases the value of that purchase.

What is a Cross Sell?

A cross sell is an offer that is complementary to the product that the potential customer has already decided to buy.

A classic cross selling example is the McDonald’s cross sell of “Would you like fries with that?”. The person has already decided to buy a burger and the cashier offers to add fries to it.

Cross selling is effective because when someone has already decided to buy something, they are likely to be open to considering adding complementary items to their order.

What’s the Difference Between Downselling, Upselling, and Cross Selling?

As you can see, all three sales techniques are similar in the sense that they all offer the potential customer something that they did not intend to buy.

That being said, the timing is completely different:

- You offer a downsell when a customer has rejected your offer.

- You offer an upsell when the customer has accepted your offer and is about to make the purchase.

- You offer a cross sell either when the customer has accepted your offer and is about to make the purchase or when they have already made the purchase.

Any well-designed sales funnel should implement all three sales techniques to maximize revenue.

Best Practices: How to Downsell Effectively

So how can you downsell effectively?

Here are the three best practices that you should keep in mind…

#1: Do Not Discount the Original Offer

Your initial impulse may be to use a discount on the original offer as a downsell.

Say, if your product costs $97, but the customer rejected the offer, you may be tempted to drop the price down to $67 in the hope that they will buy due to this discount.

However, while this might get you a sale, it will likely damage your business in the long run. Why?

Because when you do that:

- You train people to never pay the full price for your products. When you make someone a downsell offer like that, the next time they want to buy something from you, they will reject your initial offer just to see if they can get another discount. Why pay more when you can pay less, right?

- You offend people who did pay the full price for your products. How would you feel if you bought a product, then found out that someone else got it with a massive discount? And what if they only got that discount because they rejected the initial offer? You’d likely feel foolish for paying the full price for that product. Also, when a business does this, they are rewarding their least enthusiastic customers for their lack of enthusiasm and punishing their most enthusiastic customers for their excitement. Doesn’t make much sense, does it?

So don’t discount your initial offer. You need to have a separate downsell.

#2: Create a Downsell Offer

You will get the most out of downselling if you create a downsell offer that is designed specifically for that purpose.

You want something that offers a solution to a problem that the potential customer is struggling with. It should be either the same or relevant to the one that your original offer solves.

It’s ideal if it’s a direct downgrade from your initial offer (e.g. they aren’t interested in your $297 video course, but maybe they’ll be interested in a $7 eBook on the same subject?).

#3: Keep the Price in the Impulse Buy Range

You want to make your downsell offer so inexpensive that purchasing it would be a no-brainer.

Keep the price as low as possible, ideally within the impulse buy range. $7 is a great price point for downsells.

High Value + Low Price = Effective Downsell

The key to effective downselling is to create an offer that provides a ton of value and then charge a ridiculously low price for it.

When you are only charging $7 for something, you may feel as if you might as well give it away for free. It may seem like such an insignificant amount of money.

But check out this mind-blowing math:

$0 < $7

The customer has rejected your initial offer. They would have left without buying anything. But now they bought a $7 product. That’s $7 more in your bank account.

And as we discussed previously, even seemingly insignificant sums of money can add up to a substantial increase in revenue over time.

Conclusion

When a potential customer decides that they aren’t interested in your offer, downselling is your best shot at making a sale.

So make sure to implement it in your sales funnel:

- Create a downsell offer

- Choose a price point within the impulse buy range (<$10)

- Offer it to potential customers who have visited a sales page for one of your products, but decided not to buy it.

You might be surprised by the impact this can have on your bottom line!