Want to get more clients?

These five marketing strategies can help you do that…

What is Agile Marketing?

Learning marketing, just like learning any other skill, will inevitably involve making a lot of mistakes. That’s completely normal. And there’s really no way around it.

The problem is that this can get expensive. It’s easy to burn through your entire marketing budget without having anything to show for it when you don’t know what you are doing.

This is where agile marketing comes in:

- You come up with an idea for a marketing campaign.

- You create the minimum viable version of that campaign that allows you to get feedback from your target audience with the least possible investment.

- You launch the campaign, analyze the results, and make adjustments based on market feedback. Then you repeat the cycle again. And so on and so forth. Alternatively, if your campaign fell flat, you might want to drop it altogether, go back to the drawing board, and come up with something better.

This iterative approach allows you to validate ideas, optimize your marketing campaigns, and scale them gradually. When you fail, you fail small. Sure, losing a few hundred bucks on ads still stings, but it’s not going to put you out of business.

That’s why we strongly recommend adhering to agile marketing principles if you decide to implement any of the marketing strategies that we are going to discuss in this article. Validate, optimize, scale!

Best Marketing Strategies for Financial Advisors

Okay, so now with that out of the way, let’s get into the marketing strategies that you can use to grow your business…

Marketing Strategy #1: Paid Advertising

Paid advertising is probably the best place to start. Why?

Because paid traffic is targeted, immediate, and scalable. It’s the easiest way to put your offer in front of your dream customers.

All major social media platforms allow you to run ads:

- YouTube

- TikTok

Pick a platform that makes the most sense for your business. If you aren’t sure which one to choose, experiment with several of them, then focus on the one that works best.

Create an ad campaign and start running it with a small daily budget. Once you figure out how to run it profitably, you can begin gradually scaling it.

Then, once you have streamlined that ad campaign and it’s more or less running on autopilot, you can start expanding to other platforms.

Just keep in mind that if you want to succeed with paid advertising, following agile marketing principles is especially important. Even if everything is going great, make sure to scale your campaigns gradually.

Marketing Strategy #2: Influencer Marketing

Influencer marketing is a booming industry that is expected to grow to $21.1 billion this year.

This marketing strategy doesn’t appear to be popular among financial advisors but that gives you an opportunity to gain a competitive edge if you can make it work for your business.

While the term “influencer marketing” tends to be associated with Instagram celebrities, it’s important to understand that anyone with a substantial social media following can be seen as an influencer.

Also, pretty much everyone is on social media these days, so whoever your dream customers are, they are probably on it too. And they are almost certainly following influencers that appeal to them.

This means that if you can figure out who your dream customers follow on social media, you can use influencer marketing to reach them.

One of the best ways to do that as a financial advisor is to offer free services to relevant influencers in exchange for an honest review and a shoutout. If you can get them to agree to that and then do good work, the exposure should help you attract new clients.

Also, it’s best to target influencers who belong to your dream customer demographic themselves because that way, you might also be able to get direct referrals from them if they recommend you to their friends.

Marketing Strategy #3: Social Media Marketing

It’s important to invest in building traffic-generating assets. And the easiest such asset to build is a social media following.

If you’ve been running paid ads then you probably already know which social media platform works best for your business. That’s where you should start.

While all platforms have their own peculiarities, the general process of building a following is the same everywhere:

- Create a content schedule that you can keep up with indefinitely.

- Commit to that content schedule and adhere to it religiously. You can produce content in batches and then use social media scheduling tools like Buffer or MeetEdgar to schedule and publish it.

- Ensure that each and every piece of content that you publish provides value to your followers.

- Use your social media to promote your lead magnet but don’t be obnoxious about it. Providing value to your followers should be the main focus.

- Interact with your followers. Ideally, you want to respond to each comment, tweet, and reply that you get.

As a financial advisor, you want to share helpful tips, interesting articles/podcasts/videos, book recommendations, etc.

Of course, you need to tailor your social media content to your target audience. Common sense financial advice that applies to literally everyone such as “create a budget”, “save a certain percentage of your income”, or “live below your means” might help you build a big following but that shouldn’t be your goal.

Ultimately, you are on social media to market your services, so it makes much more sense to post content that appeals to your dream customers. That way, your following will probably grow slowly and remain relatively small, but you will be able to get leads from it and convert them into clients. And that’s what matters.

Also, realize that the most common reason why people who attempt to build a social media following fail is this: they quit too soon.

The five-step process outlined above is pretty much all there is to it. But the catch is that you have to stick with it.

Realistically, building a social media following will take time, probably a few years. So be prepared for that. Consistency is the name of the game!

Marketing Strategy #4: YouTube Marketing

Another traffic-generating asset that you might want to consider building is a YouTube channel.

This strategy works best for people who are comfortable talking on camera. However, even if you are a natural, that alone won’t be enough.

You need to be methodical about it:

- Do keyword research – Type in a general term related to the services you provide into YouTube’s search bar and look at the suggestions that come up. These are related keywords that people are searching for. Pick one.

- Do competitor research – Type in your chosen keyword into YouTube’s search bar, watch the three top-ranking videos, and read the comments. You want to figure out how to make your video better than the videos that are currently ranking for that keyword.

- Write the script – You can simply use an outline with bullet points, but usually, it’s better to prepare a word-for-word script, provided that you can read it without sounding robotic.

- Shoot the video – Don’t worry too much about production value because it’s the content that matters. That being said, you want to get the basics such as audio, lighting, and camera angles right. Of these three, it’s the audio that is the most important. People will forgive questionable video quality if the content is good but they won’t suffer through terrible audio. It’s okay to film with your smartphone but you might want to consider investing in a professional-grade microphone.

- Edit the video – Attention spans are so short that every second matters. Make sure to edit out any verbal tics, awkwardness, etc.

- Create a thumbnail – Thumbnails are arguably the most important factor when it comes to getting people to click on your videos. That’s why you need to make sure that they grab attention. You also want to have a consistent thumbnail aesthetic (color scheme, fonts, design, etc.) so that they’d be immediately recognizable to your subscribers in their subscription feeds.

- Come up with an intriguing title – As a financial advisor, you can’t use full-on clickbait because that will come across as unprofessional. Your titles should include your target keyword and describe what the video entails. However, they still need to pique curiosity, so make sure that every title has that element as well. You need to strike the right balance between informative and intriguing.

Keep in mind that potential clients will form their opinion about you from the way you present yourself on YouTube: from your profile photo to your channel art to the thumbnails and the titles to the videos themselves to how you interact with people in the comments.

Something to be mindful of here is how much personal information you share. Some YouTubers are extremely open with their audiences, while others have strong boundaries and don’t share anything about themselves beyond what’s relevant to the main subject of their channel. As a financial advisor, you should probably take the latter approach.

Also, just like with social media, when people set out to build a YouTube channel and fail, the most common cause for that is simply quitting too soon. It will probably take a few years to gain momentum. So be patient and play the long game.

And always remember that you are on YouTube to attract your dream clients, not to become an e-celeb. Your content should be tailored to appeal to your target audience. Avoid the temptation to optimize for vanity metrics such as views or subscriber count!

Marketing Strategy #5: Search Engine Optimization

Yet another traffic-generating asset that you might want to consider building is a blog.

But be warned that writing great articles won’t be enough. You will need to master search engine optimization.

Search engine optimization, also known as SEO, is the practice of generating organic search traffic.

Here’s a quick overview of the process:

- You do keyword research to identify a promising keyword.

- You do competitive research to see what’s currently ranking on the first page of Google for that keyword.

- You create a piece of SEO content that targets that keyword and is better than everything that’s currently ranking on the first page of Google for it.

- You build backlinks to that piece of content which lets Google know that it’s legit.

- You promote your lead magnet on that page with an opt-in box at the bottom of the article and an exit-intent pop-up.

Just like with social media and YouTube, gaining momentum will take time, probably a few years until you start getting a decent amount of organic search traffic.

In fact, we would argue that out of these three types of traffic-generating assets, a blog is the most difficult one to build.

If you aren’t willing to do what it takes to get your blog off the ground – especially build backlinks, as that is what people tend to struggle with the most – then it’s probably best not to start it at all.

Sales Funnels: The Best Way to Sell Your Services Online

The most common online marketing mistake that we see is driving traffic directly to your sales page or to your website.

This is a terrible way to sell your services online because you are essentially pitching random people whose attention you somehow managed to catch for a few seconds.

The potential customer will click through to your website, then get distracted by something else and leave, probably to never come back.

This is especially true if you are helping people manage their money which requires a huge amount of trust. No one is going to hire you because they clicked on your ad while mindlessly scrolling Facebook!

So what ends up happening is that you are paying for traffic – either directly with money or indirectly with your time and energy – but you aren’t converting it into clients. So what’s the point?

Fortunately, there’s no need to waste your resources like this because there’s a much better approach: driving traffic to your sales funnel instead.

A sales funnel is an automated system for converting visitors into leads, leads into customers, and customers into repeat customers.

There are several popular sales funnel models out there. Which one should you use to grow your business?

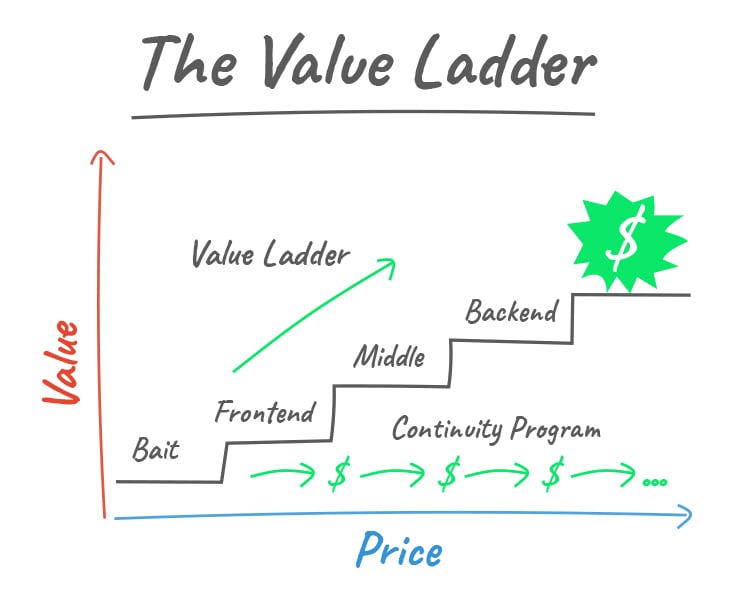

We believe that the most effective way to sell anything online is the Value Ladder sales funnel.

It was created by our co-founder Russell Brunson who then used it to take ClickFunnels from zero to $10M+ in annual revenue in just one year (it’s at $100M+ now!).

This sales funnel has four stages:

- Bait – You offer the potential customer your lead magnet in exchange for their email address.

- Frontend – You offer the potential customer your least expensive and least valuable product or service.

- Middle – You offer the customer a more expensive and more valuable product or service.

- Backend – You offer the customer your most expensive and most valuable product or service.

Ideally, you also offer a continuity program of some sort, meaning, a subscription product that generates recurring revenue.

We also recommend adding downsells, upsells, and cross sells to these core offers in order to maximize your revenue.

The reason why this sales funnel works so well is that it allows you to:

- Start the relationship with that person by offering free value.

- Nurture that relationship by continuing to provide free value via email.

- Build trust by providing progressively more paid value at each stage.

Here’s how Russell explains it:

This approach can help you make the most out of your marketing budget because it enables you to use that money to build a traffic-generating asset – your email list – instead of paying for random clicks from distracted people who aren’t ready to hire you anyway.

Want to Learn how to use Sales Funnels to Grow Your Business?

We understand that the whole concept of a sales funnel might be somewhat confusing, especially if you are used to driving traffic directly to your sales page or website.

That’s why Russell wrote a best-selling book called “DotCom Secrets” in which he explains everything you need to know about sales funnels.

Want to learn how to use them to grow your business faster than you ever thought possible? This is the book you should read.

You can get a copy of “DotCom Secrets” for FREE directly from us. All we ask is that you cover the shipping!